INTRODUCTION When a woman experiences her period or menstruates, the menstrual cycle begins. A woman's…

Era of Start-Ups in India-ease in Intellectual Property Registration to be Decisive Factor

There have been many developments recently that have streamlined the of registration of Intellectual Properties (IPs) of Start-Ups. This article discusses the chronological events and the latest position on the IP registration of Start-Ups. Under the ambitious plan, ‘StartUp India, StandUp India’, Government of India launched Scheme for Facilitating Start-Ups Intellectual Property Protection (SIPP). This move was taken primarily to facilitate registration of Patents, Designs and Trademarks for Start-Ups. This scheme attracted attention of most of the Start-Ups as scheme requires them to borne only statutory/ official fees for registration of IPs and registration of their IPs is to be handled by government appointed facilitators. Professional fees payable to facilitators is to be paid by Government and not by Start-Ups.

On March 03, 2016, IPO released forms for appointment of facilitators for patents and trademarks.

On April 22, 2016, IPO notified the scheme, application information, patent facilitators, and trademark facilitators. And on May 16, 2016, IPO notified about Patent (Amendment) rules coming into effect from May 16, 2016.

One can refer to Department of Industrial Policy and Promotion’s (DIPP) Frequently Asked Questions (FAQ’s) to understand how Start-Ups can avail the benefits of the schemes of Government of India. These frequently asked questions are related to Start-Ups, Incubators providing Recommendation/ Support/ Endorsement Letter to Start-Ups, and funding Bodies providing Recommendation/ Support/ Endorsement Letter to Start-Ups. Qualification to be defined as Start-Up, how to get benefits of various government schemes, timelines, procedure, documentation required for registration as Start-Up, who can be incubator, how to issue recommendation/ support/ endorsement letter, liabilities of incubator, what are funding bodies, liabilities of funding bodies are some of the example of questions dealt in the list of FAQs. Reader of this article is encouraged to go through the entire list of FAQs to understand the nitty-gritty regarding of the registration of entity as Start-Up.

Amended patent rules give definition of Start-Ups and amazingly apply same fees to Start-Ups as applicable to natural persons. Another big advantage given to Start-Ups is that they are eligible to apply for expedited examination as against normal examination of patent applications.

Definition of startups is given as below:

Startup‖ means an entity, where-

(i) more than five years have not lapsed from the date of its incorporation or registration;

(ii) the turnover for any of the financial years, out of the aforementioned five years, did not exceed

rupees twenty-five crores; and

(iii) it is working towards innovation, development, deployment or commercialisation of new products, processes or services driven by technology or intellectual property:…

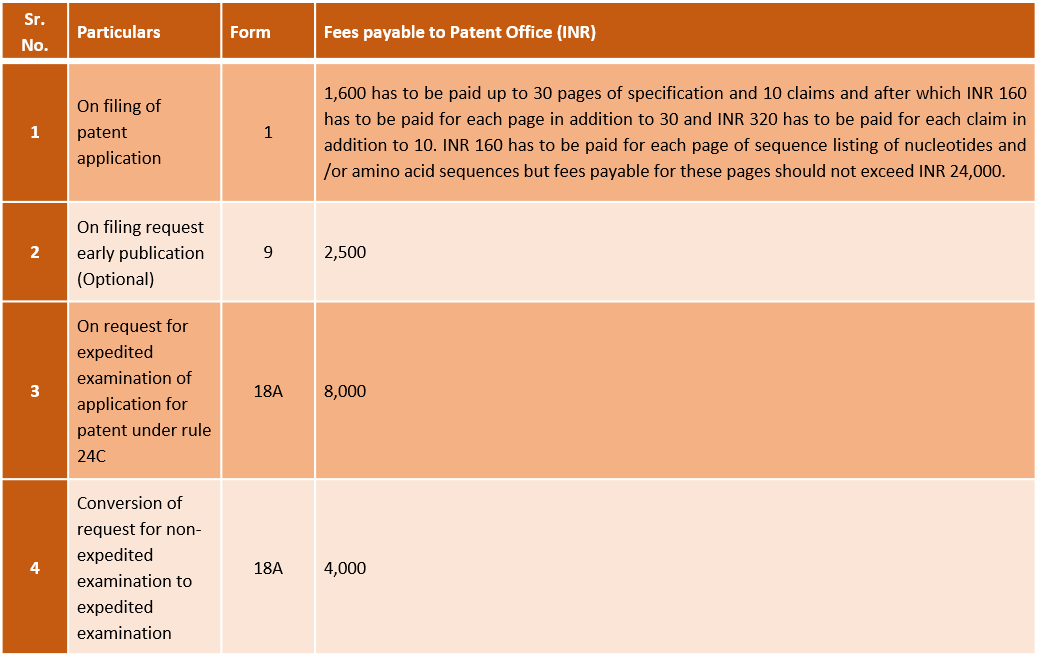

- Fees applicable to Start-Ups:

It is important to note that if an applicant is start-Up at the time of filing of patent application but ceases to be so afterwards, it will not have to pay the additional fees to patent office. However, in case of transfer of patent application to other than natural person, the person to whom application is being transferred has to pay the difference in fees applicable to Start-Ups and to itself.

- Patents:

The below table gives overview of important statutory fees that have be paid till the grant of patent.

- Trademarks:

Till trademark registration, the statutory fees have to be paid only at the time of filing of trademark application. Fees payable at the time of filing of trademark application is INR 4,000.

- Designs:

There has been no change in fees applicable to design registration so statutory fees have to borne by entity as per the current schedule. Statutory fee for conducting a standard search for establishing registrability of Design is INR 2,000 for small entity, INR 4,000 for large entity and for design application preparation and filing is INR 2,000 for small entity, INR 4,000 for large entity.

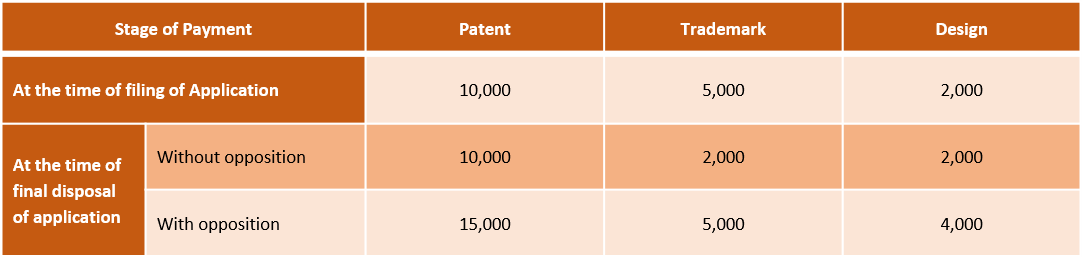

The below table gives the professional fees payable (in INR) to facilitators by Government:

In case of withdrawal or abandonment of application before disposal, facilitator shall be entitled only for filing of application and not for disposal of application.

- Eligibility to apply for expedited examination:

Start-Up applicant may request for expedited examination of patent application in form 18A with fees as mentioned in the table. It is important to note that form 18A can only be filed through electronic mode and not physical mode. After filing request for expedited examination, there is obligation on the controller to dispose off the patent application within three months from the earlier of two dates, first of them being the date of receipt of the last reply to the first statement of objections, and second date being the last date to put application in condition for grant under section 21. This time limit is not applicable in case of pre-grant opposition. The patent office deserves the right to limit the number of requests to be received for expedited examination during the year. It is beyond doubt that because of the difference in the scale of fees applicable to Start-Ups and small entities/ larges entities, advantages of expedited examination over non-expedited examination of patent applications, and appointment of facilitators, Start-Ups are feeling motivated to get their IPs registered.

About the Author: Swapnil Patil, Patent Associate at Khurana & Khurana, Advocates and IP Attorneys and can be reached at: [email protected].